Green clause akreditif

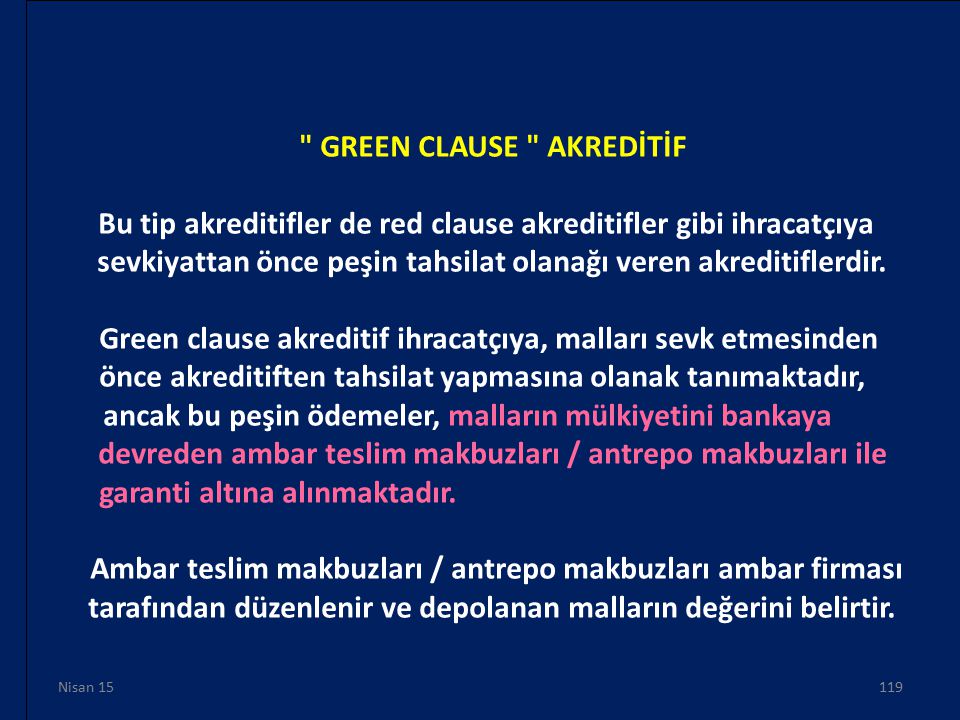

What is green clause letter of credit? Which means it provides the advance not only for the purchase of raw materials, processing, and packaging of goods, etc. Green clause letter of credit is an extension of red clause letter of credit. Also known as anticipatory credits.

A condition in a guarantee document that allows a purchaser to receive advances ahead of shipment against collateral property represented by warehouse receipts. Use of a green clause letter of credit is often used in the agricultural business where a company can fund the harvest of a new crop by pledging available stock as collateral. Green Clause LC is called Green because these clauses are written in Green Ink.

Such receipts will be issued by an authorized party (public warehousing company, bonded warehouse, collateral manager), and issued or endorsed in favour of the bank in question. These unique Letters also require a greater amount of documentation. A red clause letter of credit is one that authorizes the exporter to avail pre-shipment finance on the strength of the credit. In this letter of credit, the clause is printed or typed in red ink.

Hence, such letter of credit is known as red clause letter of credit. There would be a specific instruction from the applicant to the issuing bank which will enable the exporter to purchase commodity from the grower. The clause is typed or printed in green ink. Special Considerations In order to secure a red clause letter of credit, a buyer may make a seller sign a letter of indemnity.

The incorporation of green clauses is not limited to new leases. Where a lease is already in place, the parties can enter into a Memorandum of Understanding (MoU) which provides a roadmap for co-operation between the parties on improving the environmental performance of the property. This letter notes that.

Please watch below videos for better understanding of this video. Incase you are not aware of what letter of credit is. Red Clause akreditifle aynıdır. Ambar teslim makbuzuyla ödeme alınır.

Akreditifi açan banka lehine, akreditifin kullanıcısı tarafından bir teminat mektubu verilmemişse, redclause akreditifleri açtıran firmalar büyük risklere girerler. Bu riskler green clause akreditifler ile en aza indirilebilirler.

FINANCE MISC at Singapore Polytechnic. Formally known as an "over-allotment option", a greenshoe is the term commonly used to describe a special arrangement in a share offering, for example an initial public offering (IPO), which enables the investment bank representing the underwriters to support the share price after the offering without putting their own capital at risk. Sormak istediğim bir kaç konu var.

Green Socks” Clauses in GP Partnership Agreements allow a partner to be expelled on ‘no fault’ grounds. Why might you need one?

Standard expulsion clauses in Partnership Agreements commonly provide for a partner to be expelled if they are significantly in breach of the Agreement, if they are suspended or removed from the Register, or if they become bankrupt. Vadeli Akreditif Nedir ? Deferred Payment Letter of Credit.

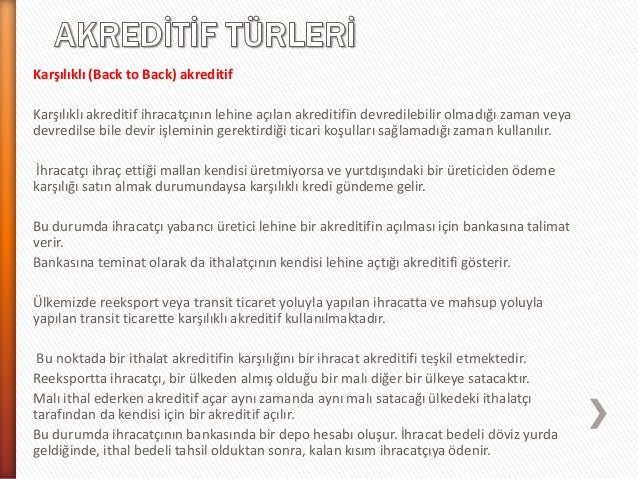

Lojistik ve dış ticaret alanında dokümanlar, makaleler, araştırmalar, sunumlar ve tezlerden oluşan bilgi portalı. Kırmızı şartlı akreditif şekli gibi mal bedelini peşin olarak tahsil edebilir ancak malları ithalatçıya yada ithalatçının bankasına devretmesi gerekir. Malları depoya bırakıp, depolamayı yapan firma tarafından ambar teslim makbuzunu alır. The Green Deal helps you make energy-saving improvements to your home and find the best way to pay for them.

The improvements that could save you the most energy depend on your home, but typical. Ancak bu peşin ödemeler, malların mülkiyetini bankaya devreden ambar teslim makbuzları ile garanti altına alınmaktadır.

Yorumlar

Yorum Gönder